YOUR City Property Taxes… Where does the money go?

THEY ARE YOUR PROPERTY TAXES… LEARN HERE WHERE THE MONEY GOES!

THEY ARE YOUR PROPERTY TAXES… LEARN HERE WHERE THE MONEY GOES!

Every spring property owners in our city watch their mailboxes, and prepare to fork over some hard-earned cash when the tax notice arrives. You have more than likely received yours by now.

These notices disclose the amount of money owed to the city and province, and can vary from resident to resident.

Calculated based on a property assessment completed earlier in the year, the taxes you are required to pay are influenced by your property’s size, quality, age, lot size, and location. Once paid, taxes are put towards supporting a variety of services within our community.

All this is fairly common knowledge that probably sounds painfully familiar to tax payers. So let’s be honest, what we really want is a simple explanation for where the money goes.

Thankfully, we’ve managed to enlist the help of Corey Wright, Director of Corporate Services with the City of Lethbridge, to make all the tax jargon, calculations, and information a little easier to digest.

Corey explains that while many people believe property taxes are solely controlled by the City of Lethbridge, this is simply not the case. “In fact, about 25 per cent of the residential tax bill is charged by the Province of Alberta and goes directly to them to fund education within the province,” he reveals.

So, where does the rest of the money go?

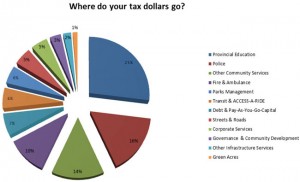

Taxes are complicated and math sucks, so it’s only natural we tax payers have developed some misconceptions about the way taxes actually work. Here’s how it all breaks down:

So now that you see where most of your dollars go, it’s obvious one of the most common misunderstandings about property taxes is that they fund all City services. In reality, only 35 per cent of these services’ operating costs come from taxes. “The remainder comes from things like utility rates, user fees, and licensing,” states Corey.

Another myth is that new infrastructure and facilities in our community are paid for by property taxes. “In fact, property taxes fund less than 10 per cent of capital projects, with a high proportion of capital funding coming from provincial and federal grants,” he adds.

While it’s understood that the market value of a property is determined in the assessment, Corey explains that many of us also incorrectly assume that when property market values increase as a whole, the City receives more tax dollars. “If market values increase overall, the tax rate is decreased correspondingly so that the total amount of property taxes charged is equal to what was approved in the operating budget,” he says.

This means that overall market values across Lethbridge don’t play a role in determining the amount of revenue collected. However, changes in market value do affect taxes when you’re dealing with a specific property.

The average property tax bill for 2014 increased an average of 2.88 per cent from last year, while market values for single family residential properties in Lethbridge increased by an average of .7 per cent. Properties that experienced an above average increase in market value will receive tax notices that have increased above the 2.88 per cent average as well. “Of course that would hold true for a property with a market value change lower than the average for the community,” Corey clarifies.

So now that you know how taxes are determined and what they fund, you’re ready to write that big fat cheque. This year property taxes are due June 30.

With all your new-found wisdom you’re ready to navigate the ever-complicated world of taxes with ease!

The deadline to pay your property taxes is June 30. For more information on your City property taxes visit www.lethbridge.ca/taxes